Be the Economist of Choice for Your Clients

“Numbers have an important story to tell. They rely on you to give them a clear and convincing voice.”

– Stephen Few

Every day our clients face an onslaught of disconnected market information and advice. The national news trumpets the latest rate hike or unemployment stats. Talk show guests debate recession and affordability. These bits of information are sliced into eye-grabbing videos and provocative headlines on social media. It adds up to an overwhelming amount of information that doesn’t make anyone informed. Meanwhile, your seller’s coworker shares how badly prices have fallen in the past few months in her hood. And their favorite podcaster prescribes renting over buying.

What all these armchair quarterbacks aren’t sharing and aren’t capable of sharing is perspective. The national narrative rarely, if ever, matches the local experience. Generic advice rarely, if ever, matches a client’s specific goals.

TwentyPercenters handle more real estate transactions in a month than most will experience in a lifetime. We have the ability to place market facts into perspective to help our clients make great decisions. We can connect data points with context to tell a story clients can both understand and act on.

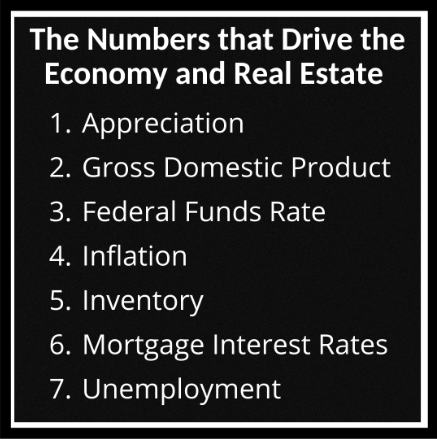

Here’s a cheat sheet on seven commonly misunderstood economic measures critical to understanding real estate and the economy.

Let’s look at what they are, why they’re important, and how to put them into a useful context. While I’m not an economist, the KW team and I have spent close to two decades placing these numbers in a helpful real estate context. The explanations below are practical rather than academic.

- Appreciation – Appreciation is the change in home prices from month to month or year over year. It can be tracked in absolute dollars or, more helpfully, as a percentage.

- Appreciation matters because the historical rise in home prices becomes a kind of forced savings for homeowners. As clients pay down the debt and prices go up, they build equity. Every Survey of Consumer Finances since 2000 has found that the net worth of homeowners is at least 35 times greater than renters.

- Long-term trends for home prices average 4% growth annually. That’s good for homeowners and for the market. Anything above that is unsustainable over time and affordability can collapse. When it’s below or negative, we can have an environment where sellers can’t profitably sell and must explore a short sale or face foreclosure. The magic number is 4%.

- Gross Domestic Product (GDP) – GDP is a measure of the dollar value of everything produced in the US. Some spending on imports is subtracted. The goal of GDP is essentially to measure if we are making more or less stuff than the previous year. Consumer spending and government investments play an oversized role in GDP. Economists watch GDP as a basic measure of the health of the economy.

- For GD, 2% annual growth reflects a healthy economy. When it rises above 4 to 5%, especially in lockstep with low unemployment, inflation rears its ugly head. The economy may be “overheating.” That’s when the Fed ratchets up interest rates to cool things down.

- Two straight quarters of negative GDP is an unofficial definition of a recession. The problem is we measure GDP by looking back. The government may not declare a recession until months after everyone knows we’re in one.

- Federal Funds Rate – The Fed Rate is a primary tool the Federal Reserve (aka the Fed) uses to influence the economy. The rate sets the target rate for borrowing and lending between commercial banks. This impacts the cost of money for businesses looking to invest and grow. After the Great Recession, the Fed dropped rates below 1% for about a decade to prop up the economy. Recently they’ve been cranking it up to cool the economy off.

- I’m not aware of any target for the Fed Rate. The goal is to set the rate to maximize employment without overheating the economy. However, the long-term average is around 4.6%. While raising the rate can be perilous for the economy, getting the rate in the 4 to 5% range is helpful. Lowering the rate is the best tool the Fed has to prop up a flagging economy. And you can’t lower rates from below 1%! There is nowhere to go.

- When the Fed manipulates the Federal Funds Rate, it’s a little like the crane machine in an arcade. The controls are very imprecise. It’s unlikely they will nab the Pikachu doll on the first try.

- Inflation – We track inflation with the Consumer Price Index (CPI). The CPI is a survey of the cost of items a typical person has to buy. It comes in two flavors—CPI and Core CPI. CPI is everything. Core CPI removes the cost of food and fuel which tend to be much more volatile.

- Prices can go up quickly but tend to come down slowly. Some economists describe this principle as “rockets and feathers” or “price stickiness.”

- Food and fuel are both more volatile and impactful than other products and services. Everyone has to eat. It isn’t a purchase we get to defer. And most people have to put gas in their car to go to work and get groceries. When food and fuel prices stay high, the economy hurts.

- The target for inflation is around 2% annually. When the CPI ranges above 3 to 4% it’s a problem.

- Rampant inflation is the government’s Freddy Krueger. If it goes on long enough, eventually people grab their pitchforks and take to the streets in revolution. If you’re wondering why the Fed is willing to risk a recession to fight inflation, this is the reason.

- Inventory – Inventory reflects the number of months it would take to sell all the available homes for sale if no more homes were put on the market.

- The story inventory tells us is whether we’re in a sellers’, buyers’, or balanced market. When inventory falls below 4 months, sellers have the advantage and there is upward pressure on prices. Above 6 months, buyers have more negotiating power and there is downward pressure on prices. In between 4 and 6 months, you have a balanced market.

- Trajectory and speed matter with inventory. When inventory grows rapidly, the market may feel more like a buyers’ market even if the measure still reflects a sellers’ or balanced market.

- Mortgage Interest Rates – You’ve got this one, right? They’re the interest rates lenders charge for home purchases.

- Long-term mortgage interest rates average between 5 and 7%. The past decade has seen unprecedented low rates after the Great Recession. Most of the news focuses on how high rates are now. It’d be more accurate to say rates have returned to normal.

- Rates directly impact the monthly cost of homeownership and the total cost (principal and interest) of a property. Here’s a good rule of thumb to remember. For a 30-year note, a 1% change in the mortgage interest rate will raise or lower the monthly payment by 10%.

- Unemployment – Unemployment measures the number of jobless people actively looking for work.

- Unemployment matters because it impacts demand in the economy and our industry. The unemployed don’t spend much money compared to employed folks. Remember, consumer spending is the largest component of GDP.

- The government likes to see unemployment around 4 to 6%. Below 4 % labor starts to get too tight and wages go up. This can cause inflation. Above 6% and unemployment weighs down the economy.

In The Upside of the Downturn, Geoff Colvin shares a study illustrating how context and perspective can save lives. Researchers showed a group of novice and veteran firefighters pictures of a fire. They asked them to describe what they saw. Novice firefighters described the parts of the building that were on fire, the color of the flames, and the amount of smoke. They could identify the facts. The veterans were able to see the flames in context. They could use their experience to tell a story about where the fire started, what it was doing at the time of the photo, and where it was likely going to spread. Their perspective allowed them to know about how the fire might act and they could use that context to save lives.

Colvin’s point was this: We make better, faster decisions when we base our actions on stories instead of a collection of facts.

So the next time you’re writing your monthly market report, don’t think of it as just another chore. It may be some of your most important work. No one is better qualified than you to put today’s headlines into context and provide practical information for buyers and sellers. Get them to turn off the news and turn to you. This will make you, not the armchair quarterbacks, your clients’ economist of choice.

One question to ponder in your thinking time: How can you become the economist of choice for your market?

Make an Impact!

Jay Papasan

Co-author of The One Thing & The Millionaire Real Estate Agent

Leave a Reply

You must be logged in to post a comment.